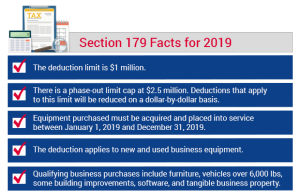

Business financing and Section 179 are often related. The Section179 tax deduction allows small businesses to make key purchases. Small business loans provide capital to purchase these assets. Small businesses can borrow money, put it towards a project and then claim Section 179 in the tax return for that year. Section 179 is a great match for business financing. Here are some important updates for Section 179 in 2019.

What is Section 179 of the Constitution?

The Section 179 tax deduction allows small business to recover a portion of the money they spent on assets that qualify. For many years, this deduction was almost exclusively for equipment. Section 179 was expanded in recent years to include a wider variety of items.

You can claim the Section 179 deduction in your annual tax return. You’ll find below some general guidelines regarding the deduction. However, we recommend that you speak to your tax advisor before making any decisions.

Why does Section 179 form part of the year-end planning?

It’s a good idea to review Section 179 at the end of the fiscal year. You’ll know how much money you’ve spent by this time. You won’t need to worry about buying something major and then realizing you want another item before the year ends. You want to maximize the returns, as the deductions cap out after a certain dollar amount. If you are $100,000 short of your cap on deductions, you could spend the $100,000 in December to have a fresh start come January. If you bought the same $100,000 in September, an investment of the same value in December would exceed your deduction and limit its value.

You can also make an purchase that you had planned to make in January at the end. You can then take advantage of the deductions for your current tax year. You can maximize your Section 179 financing and Section 179 tax deductions by planning at the end of the year.

Working Capital and Section 179 Financing: Why are they compatible?

Businesses that qualify for Section 179 can choose to finance their equipment. A specialized loan may be used to cover expensive equipment. But that’s about it. Working capital fits better with Section 179 financing and business loans because it covers your entire new strategy, not just the cost of the asset.

The Section 179 deduction can be applied to a variety of purchases. This makes the value of your working capital even more apparent. Section 179 can be used to deduct certain building improvements. Equipment financing can cover specific assets, like new conference room technology, but only that. Working capital is available to cover equipment costs, furniture purchases, redecoration and decorating fees.

You can see that equipment financing has its limitations. When it comes to Section179 and business finance, working capital may be a better option.

Are You Planning a Purchase?

QuickBridge is here to help if you are looking to purchase a Section 179 eligible item this year. You can quickly access cash with our working-capital loans. To learn more about our loans or to apply, contact us today.