Every year, the QuickBridge Small Businesses Owner Survey measures the pulse of small businesses. This year we collected responses from 560 small business owner across the U.S.

Small business owners expect strong sales

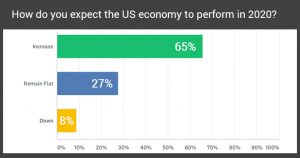

results from our 2019 survey are mirrored in our survey results for 2020. Although the U.S. GDP grew by only 2.3% in 2019, the lowest rate in the last three years, 65% of small business owners are confident that growth will continue in 2020.

According to the U.S. Bureau of Economic Analysis projects that the economy will grow at a rate of 2.6% in 2020 and 2.9% in 2021. This growth is largely based on productivity gains, which are expected to be accompanied by a gradual rise in capital expenditure and consumer confidence during the second half.

Some respondents were understandably uncertain about the impact of international trade and political issues on their businesses. Despite this, 81% of respondents said they expected their business to grow in 2020. Only 14% of respondents expect flat sales, and only 5% predict a decrease in sales.

The plans of small business owners to hire more staff in 2020 also reflect this confidence. Nearly 60% of small business owners plan to hire more staff in 2020, while only 3.4% expect to reduce their staff. 68% of small-business owners also expect their cash flow to be positive by 2020.

Small Business Capital Investments to Rise Despite Cautions

Forbes reports that capital expenditures by businesses decreased in the third quarter after two quarters of stagnation, a sign of uncertainty related to trade negotiations. Capital spending in 2020 is expected to increase due to the anticipated economic growth as well as lower financing costs.

This cautious optimism is echoed by the sentiment of business owners. In response to the question of how they anticipate the amount they spend on capital expenditures to change, half said they expected it to rise, 38% said it would remain the same and close to 12% predicted a decrease.

Small businesses are not affected by taxes and tariffs

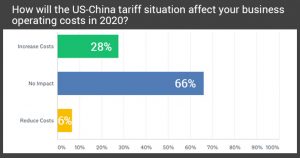

Despite the fact that some business owners are more cautious due to ongoing issues with international trade, 66% of respondents said they do not expect any impact from the U.S. China trade situation in 2020. In the same way, recent changes to tax laws have had no effect on 48% of respondents.

Over 27% of respondents said that the tariff situation would cause their costs increase. This is indicative of larger business risks associated with international trade. These include higher imports, shorter contract lengths, slower customs processes, and lower consumer demand.

The biggest challenge for small businesses is to secure capital

Small businesses are faced with a variety of challenges. This is especially true in the first few years when they are trying to gain traction. The survey of small business owners revealed that the greatest challenge for them in 2020 will be securing capital. One respondent said, “For small businesses like mine, all I need is some working capital.” For unexpected business expenses, slow seasons, paying wages and buying new equipment.

It is not surprising that small businesses face major challenges due to a lack of capital. In 2020, small business owners will face a number of other challenges, including growth, increasing profits, hiring new employees, increasing operational costs and developing new products/services.

You can view the complete results of our QuickBridge 2020 Small Business Owner Survey in this video:

QuickBridge, as a leading alternative lending company, works to improve the ability of small business owners to access financing. Our application process is streamlined to make it easier for you. We can often provide funding in a matter of days. Traditional lenders can make it difficult to qualify for small business loans. QuickBridge’s small-business loans do not require collateral, and we also consider owners of businesses with less than stellar credit. We can help your business grow in 2020. Contact us to find out more.